REPORTING FOURTH QUARTER & FY 2025 EARNINGS

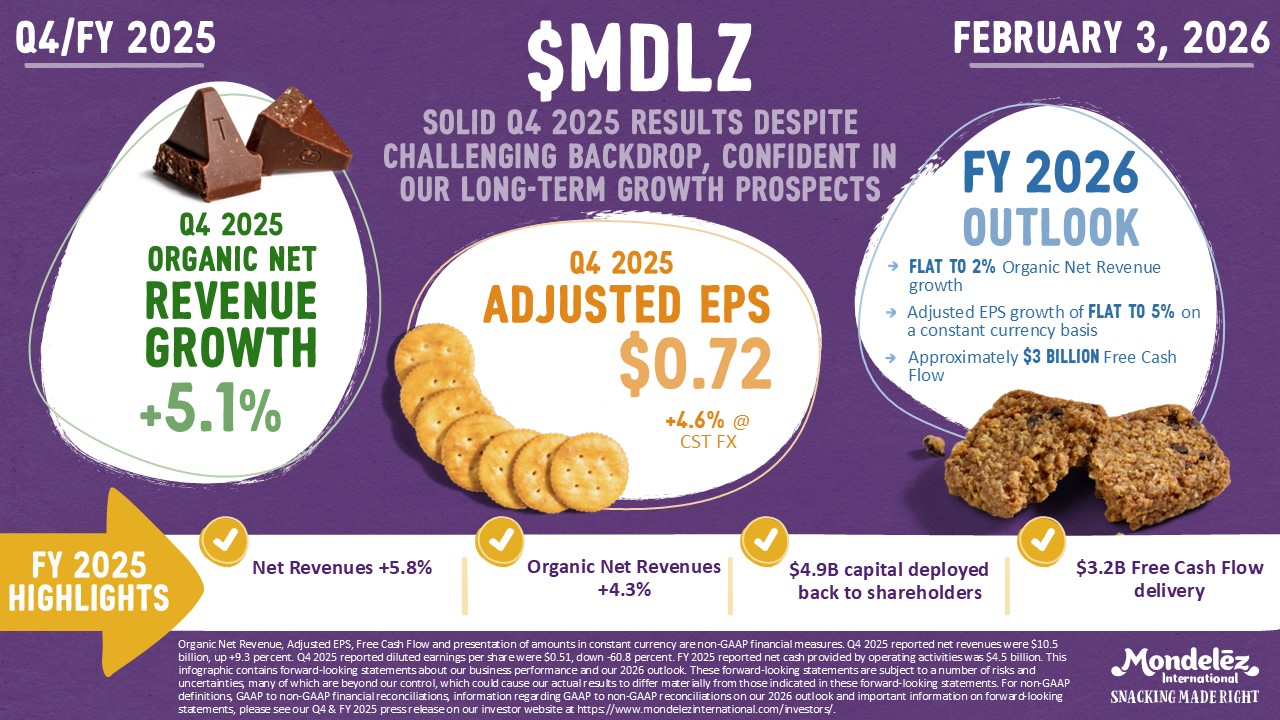

Solid Q4 2025 Results Despite Challenging Backdrop, Confident In Our Long-term Growth Prospects

+5.1%

Q4 Organic Net Revenue Growth

Tuesday, February 3, 2026

On February 3, 2026, we reported our fourth quarter and FY 2025 results.

“We delivered solid top-line results, generated strong cash flow, and returned significant cash to shareholders in a dynamic and challenging 2025 environment. While unprecedented cocoa cost headwinds impacted our profitability, our teams remained focused on what they can control to best position us for sustainable, profitable growth,” said Dirk Van de Put, Chair and Chief Executive Officer. “As 2026 commences, we are executing clear plans to create multi-year shareholder value through improved volumes, brand investments, structural cost savings and disciplined capital allocation coupled with stabilizing cocoa costs. We remain convinced that our scale across markets—along with our stable of iconic brands, extensive route-to-market capabilities and supply chain strength—give us fundamental advantages in the years to come.”

Full Year 2025 Highlights1

- Net Revenues +5.8%, Organic Net Revenues1 +4.3%, Volume/Mix -3.7%

- Diluted EPS declined -44.7% to $1.89

- Adjusted EPS was $2.92 down -14.6% on a constant currency basis

- Cash provided by operating activities was $4.5 billion

- Free Cash Flow was $3.2 billion

- Return of capital to shareholders was $4.9 billion

For more information, see our press release here.

- Organic Net Revenue, Adjusted Gross Profit (and Adjusted Gross Profit margin), Adjusted Operating Income (and Adjusted Operating Income margin), Adjusted EPS, Free Cash Flow and presentation of amounts in constant currency are non-GAAP financial measures. Please see discussion of non-GAAP financial measures at the end of the press release for more information.